Introduction

Most people know that money is an emotional topic, but not many of them realize that this is the reason why they frequently end up making bad decisions.

In the book “The Psychology of Money,” Morgan Housel sheds all the light we need to learn about how to avoid these emotional traps.

In this article, I will share the six main lessons I learned, and hopefully, by the end of the article, you will be one step ahead of your emotions. Let’s get started.

1. Wealth is what you don’t see.

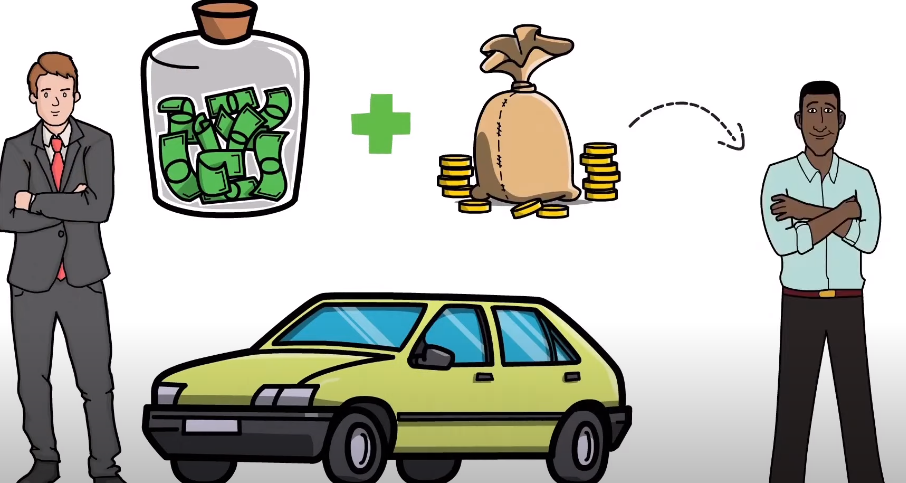

Wealth is what you don’t see. Morgan tells us a story about a man who arrived in a great car to the hotel he worked in.

He drove a Porsche, but to his surprise, one week later, the same man showed up in an old car.

It turns out that the man had a big debt to pay for the car, and when he ran into financial problems, he had to sell it. The man clearly wanted to look rich instead of wanting to be rich.

We usually judge people’s wealth by what we see. When we see someone in a great car like the man in the story, we assume they’re rich, but the only thing we actually know is that the person has less than $100,000 to spend. Having money that we can use is what makes us rich.

There is nothing wrong with having an expensive automobile or other pleasures if you can afford them. But if what you really desire is to buy things, perhaps what you want is to appear rich rather than to be rich.

Spending money to demonstrate to others how much money you have is the quickest way to have less money.

2. Money buys freedom.

We have all heard the expression “money doesn’t buy happiness,” and while we may agree or disagree with it, I think we can all agree that money can buy something far more precious: the ability to control how we spend our time.

More than our salary, more than the prestige of our job, doing what we want when we want with the people we want is one of the things that brings the biggest happiness.

That’s a privilege we can all have if we are wealthy enough. But that is not the only thing money can buy; it can also buy us options.

People who live paycheck to paycheck can’t afford to skip a few days of work for being sick because it may mean not having enough money to pay the bills. Having money saved gives us more and better options and, therefore, more control over our lives.

3. Being reasonable is more important than being rational.

More important than being rational, from all the lessons in the book, this, in my opinion, is the most important one when making financial decisions.

We often look for the option we believe will bring the best results when, instead, we should look for the one that lets us sleep better at night. Let me explain.

My friend Jack wants to start investing, and he has $5,000 for that, a huge sum of money for him.

But he is confident that it will go well, and if he loses, he won’t need that money anyway. The market has been growing these past months, so he thinks it’s the right time. He now faces two options.

Jack has been panicking for a few days and can’t even look at the app. He later decides to get out and loses half of it.

A few years later, Jack decides to try again. This time, he chooses option number two. In the first month, he buys $500, and a month later, the market crashes.

He’s losing a third of what he invested already, but he is not worried; he still has money left, so he buys $500 more.

When the market goes up, he is profiting, but when the market goes down, he’s buying more for a cheaper price.

In his mind, it is a win-win situation. He knows he is not making the biggest profits he can, but now he sleeps like a baby, and that is far more important.

4. Nothing is free.

In the world of investments, nothing comes without a cost. It’s not always a monetary price; often, it’s an emotional one, such as fear, doubt, or stress.

Understanding the hidden fees, emotional or otherwise, associated with each investment is crucial. Rather than viewing it as a burden, consider it a fee that must be willingly paid for the ultimate benefit.

5. Play your game.

Investors come in various forms, each with their own strategies and goals. Understanding your investment style is crucial. Two illustrative characters, the long-term investor and the short-term investor, represent distinct approaches.

The key is to recognize the game you’re playing, whether it’s long-term investments in future-oriented companies or short-term trading for quick gains.

Emotional Hit in Investment Trends

Both long-term and short-term investors may find success in the same trending stocks. However, the danger arises when the strategies diverge. Short-term investors may exit before a crash, leaving long-term investors taking an emotional hit. It’s a reminder to be cautious about the advice you follow, as others may be playing a different game with different rules.

6. Room for Error

Rick’s story exemplifies the importance of leaving room for error in financial planning. Unpredictable circumstances can arise, and having a safety net is essential. Whether it’s an emergency fund or savings for a specific goal, always plan with a margin of safety.

If you think six months of savings is enough, consider extending it to nine. Adding a safety margin can help avoid frustration and provide flexibility in the face of unexpected challenges.

Rick’s Bitcoin Investment

Rick, who neglected savings, had to sell his Bitcoin investment prematurely at a loss because of an unforeseen need for a motorcycle. Planning with room for error could have allowed him to capitalize on a more significant return. The key takeaway is to anticipate the unpredictable nature of life and ensure your financial plans have sufficient flexibility.

Conclusion

In the world of investments, understanding the true cost, aligning your strategy with your goals, and planning for unforeseen circumstances are essential.

Embrace the lessons of emotional resilience, strategic alignment, and room for error to navigate the complex landscape of financial decisions.